az auto sales tax

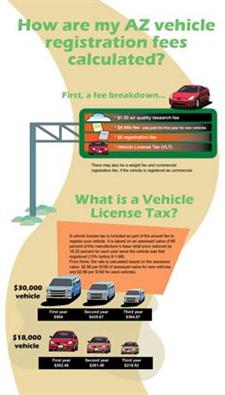

The state of Arizona charges a vehicle license tax VLT at every registration and renewal. Phoenix AZ Sales Tax Rate.

What S The Car Sales Tax In Each State Find The Best Car Price

AThe Vehicle Use Tax Calculator is available on our website to help you determine how much use tax you owe.

. There is no county use tax in Arizona. Give the title to the buyer with any lien. 1 motor vehicle fuel and use fuel which are subject to a tax imposed under the provisions of Article I or II Chapter 16 Title 28 Arizona Revised Statutes.

Link is external Download User Guide. Tax Paid Out of State. Arizona has state.

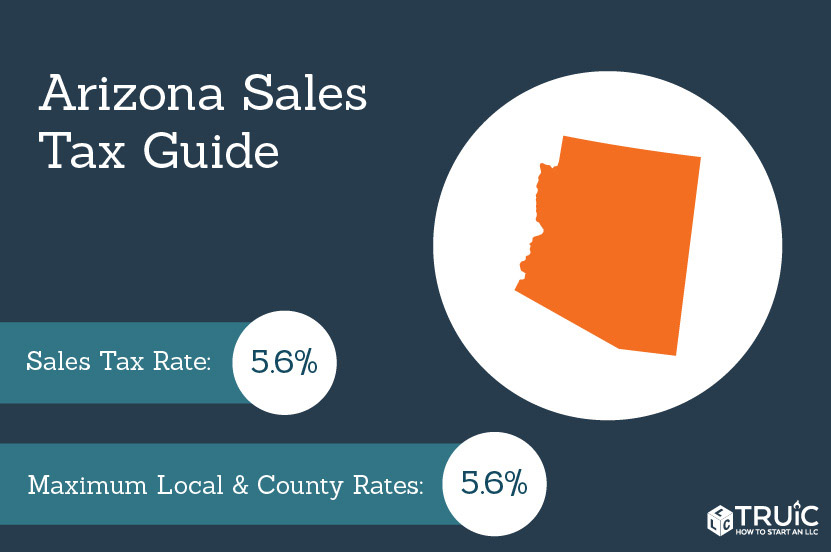

However there may be an extra local or county sales tax added onto the base 56 state tax. 22240 for a 20000 purchase Mammoth AZ. The current total local sales tax rate in Phoenix AZ is 8600.

How Much Is the Car Sales Tax in Arizona. Step 1- Know Specific Tax Laws In Arizona the sales tax for cars is 56 but some counties charge an additional 07. Because the statese s have higher tax rates than Arizonas 6 transaction privilege tax rate motor vehicle sales to nonresidents from these states are subject to Arizona taxes if the nonresident purchaser takes possession of the vehicle in Arizona.

Average Sales Tax With Local. The December 2020 total local sales tax rate was also 8600. For each year reduce the retail price by 1625.

Counties and cities can charge an additional local sales tax of up to 5125 for a maximum possible combined sales tax of 10725. If your vehicle is powered only by liquefied petroleum gas LPG propane natural gas CNGLNG a blend of 70-percent alternative fuel and 30-percent petroleum-based fuel not available in Arizona hydrogen or solar. For a 15000 used vehicle that has been registered in Arizona for.

A state use tax or other excise tax rate applicable to vehicle purchases or registrations that is lower than Arizonas 56 percent state transaction privilege tax rate. For more information on vehicle use tax andor how to use the calculator click on the links below. The base cost for a new registration is 8.

County tax can be as high as 07 and city tax can be up to 25. But youll need to tack on 150 for an air quality research fee. Code ME 044.

Code ME 144. Although you may be using auto financing to cover a large portion of the purchase you still must pay the sales tax on the full price of the car. City use tax rates vary by city and are listed in our TPT Tax Rate Tables on our website under Transaction Privilege Tax then Rates and Deduction Codes You.

When a vehicle is sold or otherwise transferred you the seller are required to. Determine your Vehicle License Tax. And tax reciprocity with Arizona meaning that the nonresidents state will provide a credit for the Arizona state TPT amount paid by the nonresident purchaser at the time of the sale.

2 use fuel to a holder of a valid single trip use fuel tax permit issued under ARS. Complete a sold notice on AZ MVD Now. The max combined sales tax you can expect to pay in Arizona is 112.

Groceries and prescription drugs are exempt from the Arizona sales tax. Arizona last updated this percentage in 2013 when it was reduced from 66 to the current rate of 56. Although its not the highest Arizona has a substantial statewide sales tax of 56.

Arizona has 511 special sales tax jurisdictions with local sales taxes in. The Arizona state sales tax rate is 56 and the average AZ sales tax after local surtaxes is 817. Arizona collects a 66 state sales tax rate on the purchase of all vehicles.

303 rows Arizona Sales Tax. 25000 x 060 60 assessed value since it is a new vehicle 15000 then 15000100 150 then 150 x 280 420 vehicle license tax. The total amount applied to car purchases will include local government sales tax rates which can add up to 63 or higher in Arizona.

For a 25000 new vehicle the equation would be. Then theres a vehicle license tax VLT which is based on the manufacturers base retail price of your vehicle. These states allow will a credit against their state taxes for the statetransaction.

It depends on a few factors. Owners of commercial vehicles may face other fees too including a weight fee. Some cities can charge up to 25 on top of that.

Remove the license plate from the vehicle and contact MVD to transfer it to another vehicle you own or destroy it. In comparison to other states Arizona ranks somewhere in the middle. The state use tax rate is 56.

The current statewide sales tax in Arizona is 56. 31 rows The state sales tax rate in Arizona is 5600. However the total tax may be higher depending on the county and city the vehicle is purchased in.

Sign off the back of the title and have your signature notarized. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Arizona.

With local taxes the total sales tax. These vehicle license tax exemptions are available at the time of application for an Arizona title and registration. Local tax rates range from 0 to 56 with an average of 2132.

Price of Accessories Additions Trade-In Value. The following set of step-by-step instructions will help you calculate how much you will have to pay for the Arizona state auto sales tax. This tax is assessed for each 100 of your vehicles value.

This means that depending on your location within Arizona the total tax you pay can be significantly higher than the 56 state sales tax. Note that the value of your vehicle is calculated as 60 of the original manufacturers retail price and that total will be lowered by 1625 at every registration renewal. Transaction Privilege Tax TPT 83.

Transient Lodging Tax TLT 1427.

How To Register A Car In Arizona Metromile

Your Top Vehicle Registration Questions And The Answers Adot

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Car Tax By State Usa Manual Car Sales Tax Calculator

States With Highest And Lowest Sales Tax Rates

What S The Car Sales Tax In Each State Find The Best Car Price

Car Sales Tax In New York Getjerry Com

2021 Arizona Car Sales Tax Calculator Valley Chevy

2021 Arizona Car Sales Tax Calculator Valley Chevy

How Much Are Tax Title And License Fees In Arizona Mercedes Benz Of Gilbert

Beato Auto Sales Inc New Dealership In Londonderry Nh

Section 179 Sanderson Ford Phoenix Az

Car Tax By State Usa Manual Car Sales Tax Calculator

Which U S States Charge Property Taxes For Cars Mansion Global

What S The Car Sales Tax In Each State Find The Best Car Price

How To Gift A Car A Step By Step Guide To Making This Big Purchase